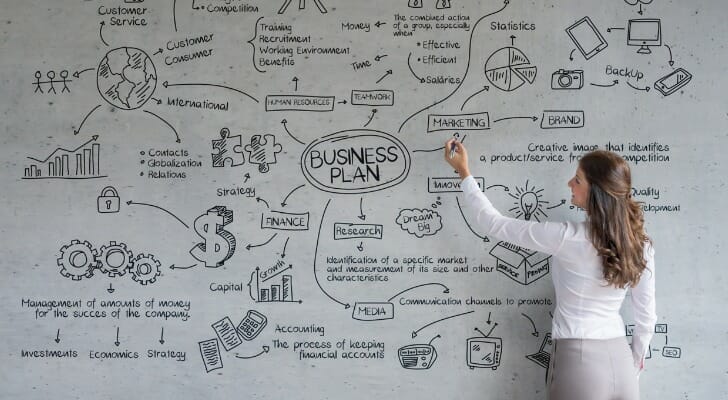

When writing a business plan, it’s important to put together a financial plan that projects future income, cash flow and changes to the balance sheet. The financial plan section often consists mostly of spreadsheets. It’s where the business owner presents a paint-by-numbers case that the business will continue to be profitable or, if it’s a startup, become profitable. The financial section is the part of a business plan that many investors turn to first, so it deserves extra attention.

Do you have questions about building a financial plan for your small business? Speak with a financial advisor today.

A business financial plan covers a specific time period or, more likely, set of time periods. A typical plan provides forecasts for the next couple of years. It may go out further in time if the plan is being used to solicit long-term financing.

Forecasts should also be broken down into shorter periods. Often the first year will include monthly forecasts, while the second year will contain projections for each quarter. For later years, an annual forecast is likely to be considered sufficient.

The financial plan portion of a business plan typically has three parts covering these topics:

The income statement portion starts by listing all sources of revenue, including sales and interest or investment income, that the business anticipates receiving over the period covered by the plan. Next it describes all the anticipated expenses, which may include inventory, wages, rent, utilities, interest on loans and taxes. On the last line of the income statement is the net income figure.

Ideally, this bottom-line net income figure will be positive, showing healthy profits. However, for many startups it may be years before the red ink at the bottom of the income statement turns black. Amazon is one of the clearest examples of this phenomenon. So, it may be less important to avoid showing losses in the early going than to demonstrate a clear path to eventual profitability.

The cash flow statement monitors the anticipated flow of cash through the business over the covered time period. It is different from the income statement, which covers revenues and expenses but doesn’t describe where cash will come from or how it will be used. The cash flow statement starts with a figure for cash on hand and concludes with a projection for the amount of cash that will be on hand at the end. The end goal of the cash flow statement is to show that the business won’t run out of cash and be unable to pay its bills.

The cash flow projection starts by describing sources of funds. This may include cash receipts on sales that are forecast to be booked during the period as well as cash expected to flow in from sales recorded on the income statement during an earlier period.

The uses of funds section is generally more complex than the sources of fund sections. It shows how and when funds will actually be disbursed to acquire inventory, cover SG&A (sales, general and administrative) expenses, make loan payments, fund distributions or draws taken by the owners and pay other bills.

The balance sheet portion of the financial plan aims to give an idea of what the business will be worth, considering all its assets and liabilities, at a future date. To do this, it uses figures from the income statement and cash flow statement.

The essence of a balance sheet is found in the equation: Liabilities + Equity = Assets. It can also be expressed as Asset – Liabilities = Net Worth. The goal of a balance sheet forecast is to show that the activities of the business are creating value. This can be done by paying off liabilities, by increasing assets or, more likely, a combination of both.

If the amount of equity or net worth is increasing from one period to the next, the business is creating wealth. This is what investors, lenders and business owners are looking for.

Unlike historical income statements, cash flow reports and balance sheets, the plan section deals with the future rather than the past. In order to estimate figures used to populate the spreadsheet cells, planners use scenario planning.

One way to do scenario planning is to generate high, medium and low forecasts. A planner may, for instance, have one forecast with a high annual sales figure of $1 million, a medium sales figure of $750,000 and a low sales figure of $500,000. Similarly, the plan will include best, moderate and worst outlooks for expenses for expenses. Ultimately the financial plan will likely illustrate several potential scenarios combining high, low and medium eventualities.

Of course, little about the future is certain, especially when it comes to details. So, a business financial plan is necessarily somewhat vague. It’s best to avoid over-complicating the financial plan section by drilling down very far into the details. Complex formulas are also often avoided in order to give a clear picture of what the plan writer is trying to communicate.

The financial plan section of a business plan is a look into the future of the business and its ability to generate profits, pay its bills and create wealth. Its main documents are income statements, cash flow statements and balance sheets. There may be several versions of these, each demonstrating the likely effects of various scenarios. Financial plans are important to business owners, people who are investing and lenders because they aid in evaluating the prospects of the business.

Photo credit: ©iStock.com/psisa, ©iStock.com/Artistan, ©iStock.com/andresr

Mark HenricksMark Henricks has reported on personal finance, investing, retirement, entrepreneurship and other topics for more than 30 years. His freelance byline has appeared on CNBC.com and in The Wall Street Journal, The New York Times, The Washington Post, Kiplinger’s Personal Finance and other leading publications. Mark has written books including, “Not Just A Living: The Complete Guide to Creating a Business That Gives You A Life.” His favorite reporting is the kind that helps ordinary people increase their personal wealth and life satisfaction. A graduate of the University of Texas journalism program, he lives in Austin, Texas. In his spare time he enjoys reading, volunteering, performing in an acoustic music duo, whitewater kayaking, wilderness backpacking and competing in triathlons.

Read More About Small Business

More from SmartAsset

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset's services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. SmartAsset receives compensation from Advisers for our services. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user's account by an Adviser or provide advice regarding specific investments.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.